Freight Forwarding Industry in India: Market Outlook and How to Set Up

We provide the market outlook and regulatory landscape of the logistics industry in India, and explain the stepwise process to set up a freight forwarding unit in India.

Increasing integration with the global economy coupled with improving production activity and consumption trends at home has presented the Indian freight forwarding industry with attractive opportunities. For instance, India’s exports amounted to US$417.8 billion and import volume rose to US$610 billion during FY 2021-22. Such high figures are indicative of the large volume of trade involving India, and validate the market demand for logistics. This has allowed the Indian freight forwarding industry to thrive.

As large corporations now prefer to focus on their core business activities, supply chain distribution gets outsourced to intermediaries. This has resulted in a demand for freight forwarders, who operate in a highly cost-effective manner. Additionally, factors like growing digitization, changing consumer preferences, and the expansion of e-commerce, as well as enabling government policies like the National Asset Monetization Pipeline and PM Gati Shakti Yojana are steering the transformation, modernization, and development of logistics industry in India.

In this article, we provide a brief primer on the freight forwarding industry in India and explain the process of setting up a freight forwarding company in India.

Who is a freight forwarder?

Freight forwarders are integral to the supply chain and act as intermediaries between the company who makes the shipment and the final destination of the goods. Although they do not carry out the shipments themselves, they offer different modes, such as sea/ocean freight, rail freight, road transport, and air freight shipment. They often use multiple modes for the transport of a single shipment.

RELATED SERVICES

- GAIN INTELLIGENCE ABOUT DIVERSIFYING YOUR ASIA SUPPLY CHAIN ⟶

For example – a freight forwarder might arrange to have the cargo moved from the plant to an airport by truck, flown to the destination city, and then moved from the airport to the customer’s city by another truck.

Freight forwarders engaged in the transportation of cargo are often referred to as second party logistics (2PL) providers. They are typically involved in preparing and processing export-import and customs documentation. However, with evolving business models, they have begun performing activities pertaining to international shipments, including packaging, documentation, warehousing, inventory management, and value-added services (VAS). In this case, they may be referred to as third party logistics (3PL) providers.

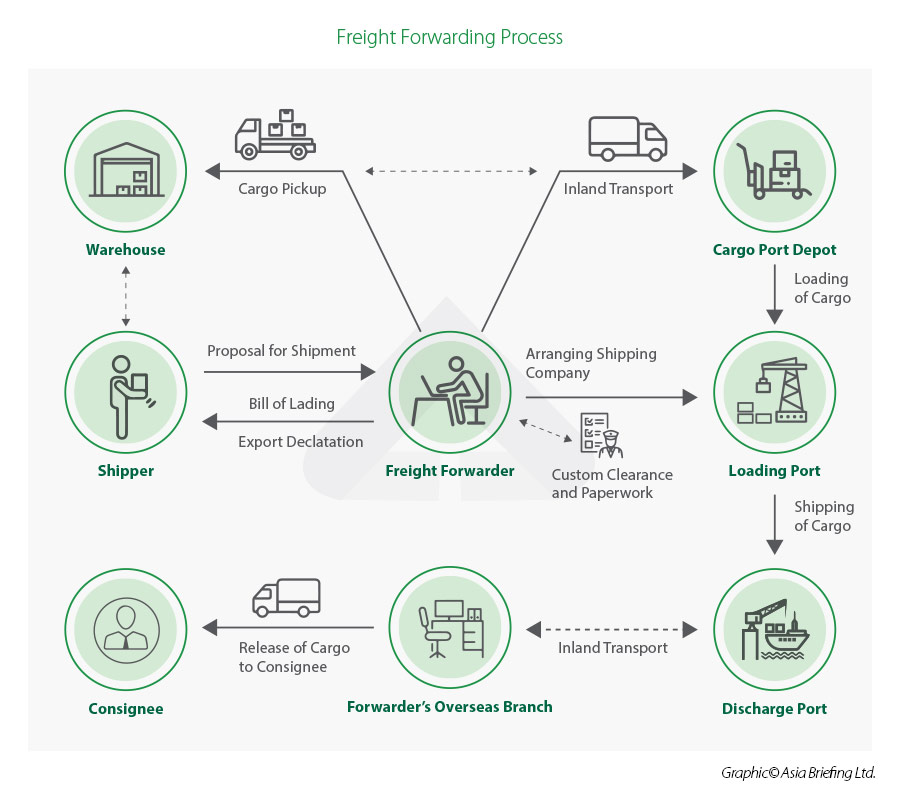

What is the process of freight forwarding?

The process of freight forwarding involves multiple stages:

- Export haulage: It refers to the transfer of consignment from its original source, that is, the manufacturing place to the freight forwarders’ warehouse.

- Export customs clearance: In this stage, the consignment receives clearance for shipment.

- Origin handling: It refers to the inspection and validation of the cargo against the booking documents.

- Import customs clearance: It involves the unloading and customs clearance paperwork for cargo, which will be inspected by the respected authorities.

- Destination handling: It refers to the handling of consignment being shipped once it reaches the destination, including transfer to the import warehouse.

- Import haulage: It refers to the final transfer of consignment from the import warehouse to the buyer’s place.

In this process, the information typically required by a freight forwarder includes documents required by the carrier or country of export, import, and/or transshipment. They include the following:

- Commercial invoice

- Packing list

- Export shipping bill

- Certificate of origin

- Letter of credit – if applicable

- Insurance certificate

- Bill of lading

- Declaration of hazardous cargo – if applicable

How to set up a freight forwarding unit in India?

While setting up a freight forwarding unit in India, the following steps are to be kept in mind:

Step 1: Decide the business model

The foremost step is to decide on the business model, depending on the corporate strategy and long-term goals. The entrepreneur willing to start a freight forwarding unit in India can either start their own venture or opt for acquiring a franchise.

RELATED SERVICES

- OUR EXPERTS ON THE GROUND CAN HELP YOU SET UP

Once the decision about the business model is made, the entrepreneur needs to decide on the type of business entity structure for incorporation. This decision will be based on various considerations like tax implications, due diligence, compliance burden, investment and funding, and exit strategy.

The entrepreneur can opt for either of the following business structures:

Sole Proprietorship

A Sole Proprietorship is an enterprise that is wholly controlled by one person. Many entrepreneurs start small businesses in their names and continue as sole proprietors. Such an establishment and its owner are not considered separate entities. There is no formal registration required to start a business in India under Sole Proprietorship.

While it is easy to register this entity, the proprietor must bear responsibility for all liabilities. The practical implication of such an agreement is that the entire profit made by sole proprietor is in the hands of the owner. For example – no separate tax returns are required to be filed and the income incurred by the proprietor must be disclosed in the personal income tax returns itself. This ownership model is cost effective and offers great flexibility in decision making.

Partnership Firm

Governed by Indian Partnership Act 1932, in a partnership firm, two or more people come together to work and earn profits. There is a partnership deed that specifies the invested interest of each partner and their profit-sharing ratios along with other terms of business functioning and operations.

The partners are responsible for all liabilities and there is no limit to it. When it comes to the registration of a partnership it is not mandatory but suitable to get it registered. The most evident benefit of such a business structure is the ease in fund raising as well as shared responsibility.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) is incorporated under the Limited Liability Partnership Act, 2009. As opposed to partnership firms, partners in an LLP are not burdened with unlimited liabilities caused by the business. Their responsibility towards losses or debts is limited to investments made by them. An LLP and its partners are considered separate legal entities.

Further, no partner is liable on account of the independent actions of other partners, thus individual partners are safe and shielded from joint liabilities upon commission of another partner’s misconduct. The most evident benefits of an LLP include – no minimum capital requirement, no limitation on number of business owners, low registration cost and limited compliance burden.

Private Limited Company

As per Section 2(68) of the companies Act 2013, a private company is defined as a company having a minimum paid-up share capital as may be prescribed, and which by its articles, restricts the right to transfer its shares, except in case of One Person Company, limits the number of its members to 200. It prohibits any invitation to the public to subscribe for any securities of the company.

Most start-ups and businesses in India with higher ambitions choose Private Limited Company as a suitable business structure due to its benefits like higher borrowing capacity, continued existence as well as easy exit, and complete procession of property. Moreover, a person in a Private Limited Company can be a shareholder/employee/director at the same time.

Public Limited Company

As per Section 2(71) of the Companies Act, a public company means “a company which is not a private company”. A public limited is formed by a minimum of seven persons with a minimum paid-up capital.

The company may get listed in the stock exchange and thereafter shares of the same are traded openly. There are more legal restrictions on this type of establishment than a Private Limited Company.

One Person Company (OPC)

As per Section 2(62) of the Companies Act 2013, a “one person company” means a company that has only one person as a member. All the shares can be owned by one person but there must be an additional nominee director to register this firm.

Similar to a Company, an OPC is a separate legal entity from its promoter, offering limited liability protection to its sole shareholder, while having continuity of business and being easy to incorporate. However, its biggest advantage is that it can be incorporated with just one person, unlike an LLP or a Private Limited Company where at least two people are required for incorporation.

Step 2: Register for mandatory compliances

In order to start and undertake freight forwarding business in India, the entrepreneur must obtain mandatory licenses. They include the International Air Transport Association (IATA) License, in case a freight forwarder plans to operate at international scale, and Air Cargo Agent Association of India (ACCAI) license.

RELATED SERVICES

Other important registrations in India include registration with the Tax Department, DGFT, Registrar of Companies, GST, etc.

Additionally, depending on different modes of transportation, a freight forwarder might require different licenses for operating in a particular country.

Freight forwarding industry in India

Market outlook

In FY 2020-21, the market size of the Indian logistics market was around US$250 billion, estimated to reach US$380 billion by 2025. Post pandemic, the logistics industry in India is poised for high growth at a CAGR of 10-12 percent, with the aid of digitization.

While infrastructure readiness and technology are expected to be primary engines of its growth, other trends propelling its momentum include the adoption of technology for tactical, strategic, and operational decision making, routing, fleet optimization, and data analysis. Digital freight forwarding units have mushroomed in the recent times, with trends like “Uber for freight” gaining popularity. Most freight forwarders are now going digital, making the process of booking freight accessible and easy, at the reach of a click.

India has done considerably well in the development of infrastructural connectivity through programs like constructing freight corridors, Sagarmala, Bharatmala. The most recent federal budget has increased spending for the development of connectivity infrastructure projects.

Additionally, in the pursuit for enhanced quality and reduced costs, market leaders are expected to leverage the Internet of Things (IoT), automation technology, blockchain technology, cloud computing, advanced / big data analysis, artificial intelligence (AI), and robotics, in the logistics domain.

Regulatory landscape

In India, a freight forwarder is governed by THE following statutes:

1) Multimodal Transportation of goods: The Multimodal Transportation of Goods Act, 1993

2) Carriage of goods:

- Land: Carriage by Road Act, 2007; The Railways Act, 1989.

- Sea: The (Indian) Bills of Lading Act, 1856; The Carriage of Goods by Sea Act, 1925; The Merchant Shipping Act, 1958; The Marine Insurance Act, 1963.

- Air: The Carriage by Air Act, 1972.

3) Warehousing: The Warehousing (Development and Regulation) Act, 2007.

4) Draft National Logistics Policy (NLP): The Union Budget 2022-23 has given thrust to the logistics industry in India, through the PM Gati Shakti Program. The NLP, which has been in discussion for quite a while will be soon implemented to ease the supply chain bottlenecks and expedite the development of an integrated logistics ecosystem in India. It is aims to reduce the cost of logistics in India from 14 percent of GDP to 10 percent.

Leave a Reply